As a business owner in Nigeria, particularly in the healthcare sector, you’re likely familiar with the challenges of accessing credit facilities. And if you are familiar, then there’s a possibility that you’ve also heard the term “MPR”, meaning Monetary Policy Rate.

In this article, we’re going to walk you through what the MPR means, its recent trends, and how it affects hospitals, pharmacies, medical equipment suppliers, and other kinds of businesses, especially those seeking loans.

What is Monetary Policy Rate (MPR)?

The Monetary Policy Rate (MPR) is the interest rate determined by the Central Bank of Nigeria (CBN) to regulate the money supply in the economy. It serves as a guide for commercial banks to determine their lending and deposit rates.

In very simple terms, MPR influences the cost of borrowing money and the returns on your savings.

Think of the MPR like an air conditioner. When your room gets too hot (inflation is high), you turn on the AC (the Central Bank raises the MPR). The room cools down, but the electricity bill goes up (borrowing becomes more expensive). To save cost, you may decide to turn off your refrigerator and air fryer(that means taking fewer or smaller loans).

When the room is cooler (inflation is low), you can turn off the AC (reduce the MPR). This saves on electricity (makes loans cheaper), so you can use your appliances comfortably (borrow more easily).

In this scenario, the weather is the country’s economy, and the Central Bank of Nigeria holds the remote control to the AC (the MPR), adjusting the temperature to suit the weather conditions.

How Does MPR Affect Businesses in Nigeria?

Changes in the MPR have a ripple effect on the economy, impacting businesses, including those within and outside the healthcare sector.

Here are some ways MPR affects businesses:

– Borrowing Costs: An increase in MPR leads to higher borrowing costs for businesses. This can reduce their ability to invest in growth initiatives, such as expanding their services or upgrading equipment.

– Cash Flow Management: Higher interest rates can also affect cash flow management, as businesses may need to allocate more funds to service their debts.

– Investment and Growth: On the other hand, if the MPR decreases, borrowing can get cheaper, encouraging businesses to invest in growth initiatives and expand their operations.

Recent Trends in MPR and Inflation in Nigeria

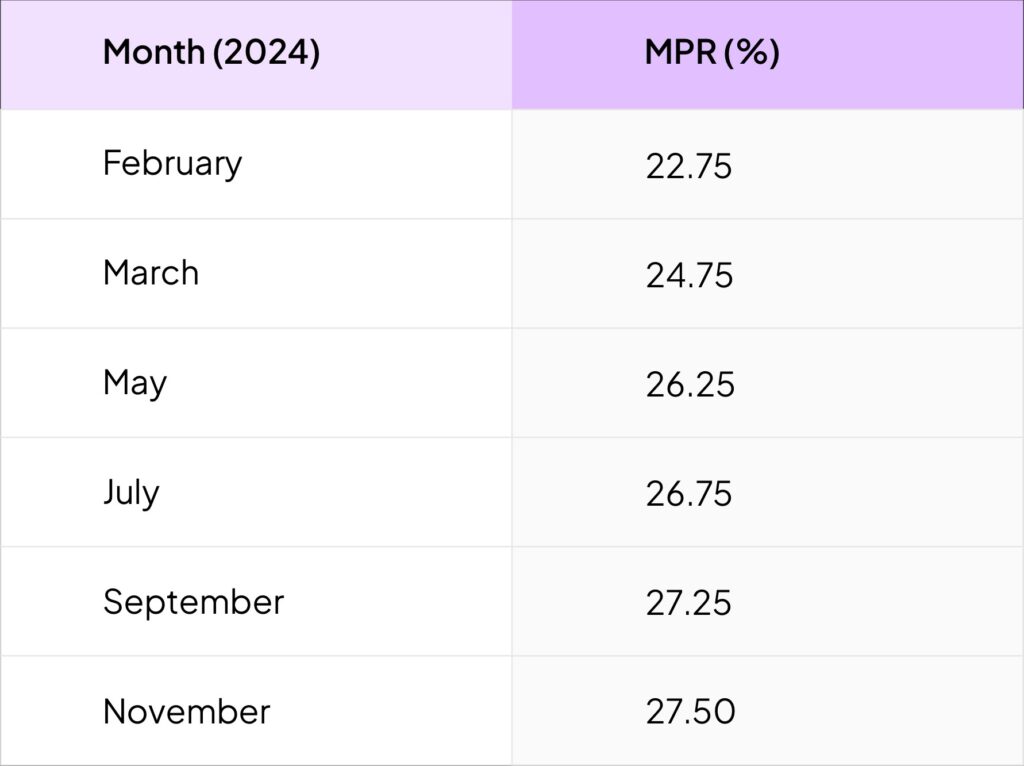

In November of 2024, the Monetary Policy Committee of the CBN convened and adjusted Nigeria’s Monetary Policy Rate (MPR) to 27.5%. This increase of 25 basis points from the previous rate of 27.25% was implemented to regulate inflation and stabilize the economy.

This year, the MPR has been raised altogether by 850 basis points.

Why Does the CBN Constantly Adjust the MPR?

The Central Bank of Nigeria (CBN) raises the Monetary Policy Rate (MPR) to achieve specific economic objectives. The primary reasons for increasing or reducing the MPR include:

1. Controlling inflation

One of the primary reasons for raising the MPR is to combat rising inflation. By increasing the interest rate, the CBN aims to reduce the money supply in the economy, thereby curbing inflationary pressures.

2. Maintaining Exchange Rate Stability:

The CBN also raises the MPR to stabilize the exchange rate. A higher interest rate can attract foreign investors, increase capital inflows, and reduce pressure on the naira, ultimately stabilizing the exchange rate.

3. Economic Growth

Lowering the MPR can boost economic growth by increasing the money supply and credit growth, stimulating economic activity, investment, and job creation

4. Maintaining stability

Finally, the CBN raises the MPR to maintain financial stability. By increasing the interest rate, the CBN can reduce the risk of asset price bubbles, prevent excessive borrowing, and maintain a stable financial system.

The Monetary Policy Rate (MPR) plays a crucial role in shaping the Nigerian economy, including the healthcare sector. As a business owner, it’s important to understand the implications of MPR changes on your business.

At NucleusIS, we’re committed to supporting healthcare businesses not only with collateral-free loans, but the support to navigate the challenges of accessing credit facilities in Nigeria.

Ready to access up to 20 million naira to scale your business? Click here to apply now

Leave a Reply